North Vancouver, B.C., February 3, 2021 – Lion One Metals Limited (TSX-V: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce recent shallow and deep high-grade gold drill results from two diamond drill holes, both still in progress, at its 100% controlled Tuvatu alkaline gold project, Fiji.

Highlights:

- Hole TUDDH520, a southeast oriented diamond drill hole still in progress, has encountered high-grade gold mineralization including 12.45m grading 21.31 g/t Au including 0.35m grading 544.00 g/t Au in a shallow intercept through the URW1 lode at a down hole depth beginning at 90.10m, or a depth below surface of approximately 75m (see table below). Historic drilling in this area only returned 2m grading 6.4g/t Au (TUDDH076 from 101m), however these new results show a wider width, multiple structures and visible gold indicating a stronger mineralized system in the near-surface. Interestingly, an older drill hole, TUDDH160, encountered a very high grade intercept of 0.50m grading 1,614 g/t Au in the URW1 lode about 320m below this new intercept. Lion One now takes the view that the URW1 lode is likely a deep-rooted high-grade lode structure worthy of further extensional deep testing.

- An intercept of 2.35m grading 4.00 g/t Au including 0.45m grading 13.58 g/t Au was encountered deeper in hole TUDDH520 at a down hole depth of 125.85m. This intercept corresponds to the URW2 lode.

- Hole TUDDH520 is still in progress. Drilling was recently suspended for a few days as a major weather system event affected site.

| Hole | From (m) | To (m) | Length (m) | Gold (g/t) |

| TUDDH520 | 90.10 | 102.55 | 12.45 | 21.31 |

| includes | 90.10 | 91.30 | 1.20 | 161.85 |

| with | 90.10 | 90.45 | 0.35 | 544.00 |

| and includes | 94.90 | 102.55 | 7.65 | 9.01 |

| with | 95.70 | 96.05 | 0.35 | 16.32 |

| and | 97.30 | 98.70 | 1.40 | 28.23 |

| and | 100.70 | 101.00 | 0.30 | 17.74 |

| and | 102.30 | 102.55 | 0.25 | 41.98 |

| 125.85 | 128.20 | 2.35 | 4.00 | |

| includes | 126.60 | 127.05 | 0.45 | 13.58 |

| and | 127.50 | 127.70 | 0.20 | 11.82 |

Note: true width of intersections are yet to be accurately determined due to the distance below the known resource, the numerous lodes intersected to date, and variability or oriented core data at depth.

- Hole TUDDH517W, a north-oriented diamond drill hole, encountered 0.3m grading 114.10 g/t Au beginning at a down hole depth of 594.60m (please see table below). This intercept is believed to be in a splay structure coming off of a nearby deep high-grade lode being targeted by Lion One. This hole is still in progress, and drilling will resume as site weather conditions improve.

| Hole | From (m) | To (m) | Length (m) | Gold (g/t) |

| TUDDH517W | 590.00 | 590.50 | 0.5 | 2.66 |

| 594.60 | 594.90 | 0.3 | 114.10 |

- Two underground drill rigs purchased by the Company and discussed in a news release dated November 4, 2020, are now expected to arrive in Fiji around February 7. These drill rigs will allow Lion One to accelerate drill testing of the deep high-grade discovery and allow continuous drilling through the wet season. In preparation for the arrival of these new drill rigs, Lion One’s technical crew has begun preparing multiple drill stations within the existing Tuvatu decline and other underground workings. Underground drilling allows certain advantages including: 1) decreasing the length of holes needed to reach target depth, 2) more favorable angles at which deep, steep high-grade structures can be intersected, and 3) year-round, continuous drilling.

“We are starting to see a clearer picture develop around which lode structures are deep-tapping and likely prospective for high-grade gold mineralization,” commented Dr. Quinton Hennigh, technical advisor to Lion One. “Our recent shallow drilling shows that the URW1 lode is one of these. We are seeing very high gold grades in this lode, a likely product of deep-sourced gold-rich fluids having utilized this structure as a main conduit at the time of gold deposition. This bodes well for deep potential on this structure, too. In addition to these exciting shallow results, we are seeing yet further high-grade intercepts in our deep target regime that bolster our confidence in that part of the system. We hope to generate a long stream of such exciting drill intercepts as we ramp up our drill program at Tuvatu through the early part of 2021 and beyond.”

Survey details of diamond drill holes discussed in this release

| Hole No | coordinates | RL | dip | azimuth | Depth | |

| N | E | (m) | (TN) | (m) | ||

| TUDDH517W1 | 3920484 | 1876723 | 359.5 | -75 | 320 | 809 |

| TUDDH520 | 3920570 | 1876342 | 287.33 | -50 | 092 | 197.8 |

Drilling and Assay Processes and Procedures

The Company is utilizing its own diamond drill rig, using PQ, HQ and ultimately NQ sized drill core rods. Drill core is logged by Company geologists and then is sawn in half and sampled by Lion One staff.

Samples are analyzed at the Company’s own geochemical laboratory in Fiji, whilst pulp duplicates of samples with results >0.5g/t Au are sent to ALS Global laboratories in Australia for check assay determinations. Assays reported here will be sent to ALS Global Laboratories for check assays shortly. All

samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10g/t Au are then re-analyzed by gravimetric method. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples sent to ALS Townsville, Queensland, Australia are analyzed by the same methods (Au-AA26, and also Au-GRA22 where applicable). ALS also analyze for 33 pathfinder elements are analyzed by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES. (method ME-ICP61).

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Stephen Mann, P. Geo, Managing Director of Lion One, who is a qualified person pursuant to National Instrument 43-101 – Standards of disclosure for Mineral Projects (“NI-43-101).

About Tuvatu

The Tuvatu gold deposit is located on the island of Viti Levu in the South Pacific island nation of Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

About Lion One Metals Limited

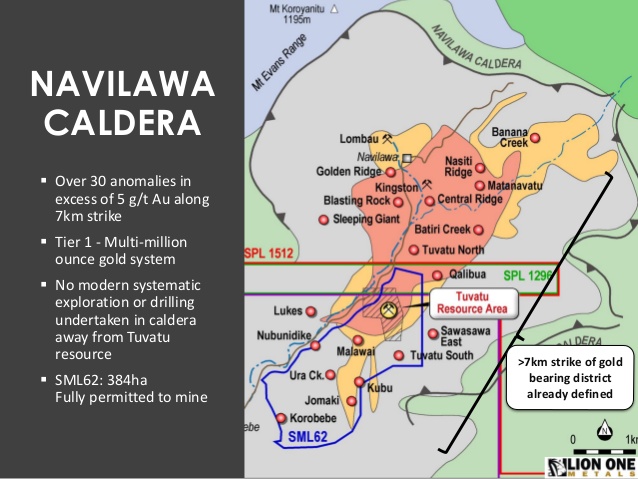

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

How Electric Car Makers Can Help Reduce Ocean Dumping

The ocean waters surrounding eastern Indonesia and Papua New Guinea lie within the biodiverse Coral Triangle, home to some of the world’s most highly concentrated – and endangered – coral reefs. In addition to being globally significant ecological sites, the reefs supply habitat for several important commercial and subsistence fisheries central to local communities’ lives.

Meanwhile, the area’s nickel deposits are attracting the attention of electric vehicle manufacturers, which rely on batteries containing nickel and other minerals like lithium and cobalt. Nickel demand is expected to increase six-fold by 2030 and Indonesia, which is already the world’s largest nickel producer, is dramatically scaling up production to meet it.

But it will require an about-face on a pollution problem that has plagued the country’s mining sector for years: deep sea disposal of mine waste, known as tailings. Indonesians have long opposed the practice, citing evidence that the tailings would decimate fragile reefs and strain fisheries already suffering the impacts of the coal plants used to power existing operations.

Tesla CEO Elon Musk famously promised a “giant contract” to any company able to source nickel “efficiently and in an environmentally sensitive way”. Earlier this month, Tesla submitted an investment proposal to the Indonesian government. The next day, the country announced that new mining projects would not be permitted to dump waste into the ocean.

Tesla’s move shows the power that companies have to demand responsibly sourced minerals in their products. They must use this power to ensure that the path to a clean energy economy isn’t littered with mine waste and human rights abuses.

Each year, mining companies dump over 220 million tons of hazardous mine waste, known as tailings, directly into oceans, rivers and lakes. Tailings are the sludge that remains once the mineral is extracted from the ore. They contain processing chemicals and naturally occurring elements such as arsenic that become toxic when exposed to air or water. This dangerous cocktail smothers fragile organisms living on the seafloor. The tailings can also spread, contaminating sea life consumed by residents and destroying coral reefs and other habitats.

Ocean dumping is a cheap and convenient way to dispose of mine waste, but it has been phased out or prohibited in most parts of the world due to its environmental and health impacts. Some mining companies still want to do it, a few governments still allow it, and the world’s largest banks and investment firms still profit from it.

If Indonesia follows through with its promise to move away from ocean dumping, two major projects, one an expansion of the Indonesia Morowali Industrial Park and the other a new processing facility on Obi Island, must develop safer plans to manage tens of millions of tons of waste. Chinese companies are backing both projects, which play a role at nearly every point of the nickel supply chain, from mine to factory.

While it is exciting to take Indonesia off the list of places willing to permit ocean dumping, it’s important to point out that the decision only applies to new mines. The world’s largest ocean-dumping mine – Newmont Mining’s Batu Hijau project – is in Indonesia and there’s no sign of that changing. Existing and planned mines in neighbouring Papua New Guinea have similar pollution problems.

Viable and affordable alternatives for managing tailings are proven and broadly employed across the mining industry. And by improving the efficiency with which we use and reuse existing mineral supplies, we can minimise the need for additional mining.

The financial sector is also responding. Citigroup, Standard Chartered and Credit Suisse have prohibited or severely restricted financing for ocean dumping. Leading Norwegian asset manager, Storebrand, recently divested from Metallurgical Corporation of China over unacceptable environmental damage at the Ramu nickel and cobalt mine, which dumps millions of tons of mine waste into Coral Triangle waters each year.

The climate and clean air benefits of electric vehicles should not come at the cost of marine and land biodiversity in remote areas, marginalising the lives of residents and workers. Companies looking to profit from clean technology must use their market power to ensure the mined materials used in their products are sourced responsibly, whether it’s nickel from Indonesia, cobalt from the Democratic Republic of Congo, or lithium from Argentina.

Doing so will give them a marketing edge. Tesla is not the only company with customers that demand sustainable products. Pressure is mounting from consumers and investors to ensure that mineral sourcing for electric vehicle batteries and other low-carbon technologies is as responsible as possible. Failing to get ahead of this issue could damage cleantech companies’ reputations – or worse, the reputation of the clean energy transition itself. And that, as the climate models indicate, would be catastrophic.

Pius Ginting is the coordinator of Aksi Ekologi dan Emansipasi Rakyat in Indonesia.

Payal Sampat is the mining program director at Earthworks in the United States.

This article appears courtesy of China Dialogue Ocean and may be found in its original form here.

The opinions expressed herein are the author’s and not necessarily those of The Maritime Executive

Newcrest cuts 2020 gold production forecast

Newcrest Mining (ASX: NCM) has lowered its gold production forecast for the full year due to reduced output following the sale of its interest in the Gosowong mine in Indonesia.

Australia’s largest listed gold miner cut gold production outlook to between 2.1 million ounces and 2.2 million ounces for fiscal 2020, from 2.38 million ounces to 2.54 million ounces.

On the exploration side, Newcrest announced that drilling at Red Chris has confirmed the presence of a discrete ‘pod’ of high-grade mineralization within the East Zone about 100m long, 100m wide and 200m high.

Last year, Newcrest acquired a 70% joint-venture interest in the Red Chris copper and gold mine in British Columbia, Canada, as part of an ongoing push by the world’s top bullion miners to get even bigger.

LAST YEAR, NEWCREST ACQUIRED A 70% JOINT-VENTURE INTEREST IN THE RED CHRIS COPPER AND GOLD MINE IN BRITISH COLUMBIA

Infill drilling is planned to fully define the extent of the mineralization and to search for additional high-grade pods within the East Zone. The underground mining concept study, currently in progress, will evaluate the option of stoping any high-grade pods ahead of other bulk underground mining methods to bring high-grade ore into production earlier.

Work also continues on evaluating the commencement of a decline late in the 2020 calendar year to further enhance and accelerate exploration efforts, with such a decline also being of use for any underground mining operation, Newcrest said.

Drilling at Havieron in the Paterson region of Western Australia continues to expand and demonstrate the continuity of high-grade mineralization, which extends over 450m to vertical depths of 600m and remains open at depth and to the northwest.

An additional 20,000 metres are planned to be drilled to support the objective of delivering of a maiden resource estimate in the second half of calendar year 2020, Newcrest said.

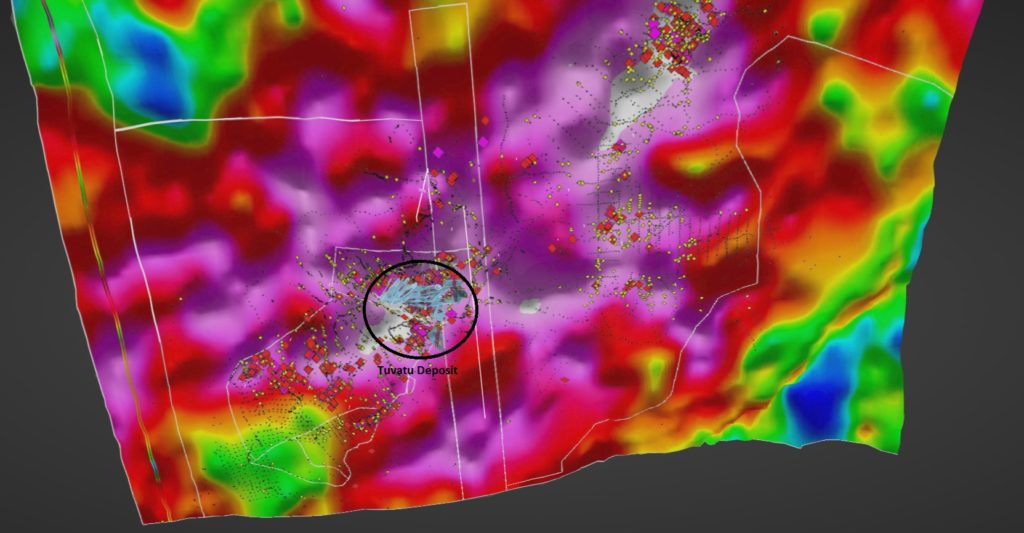

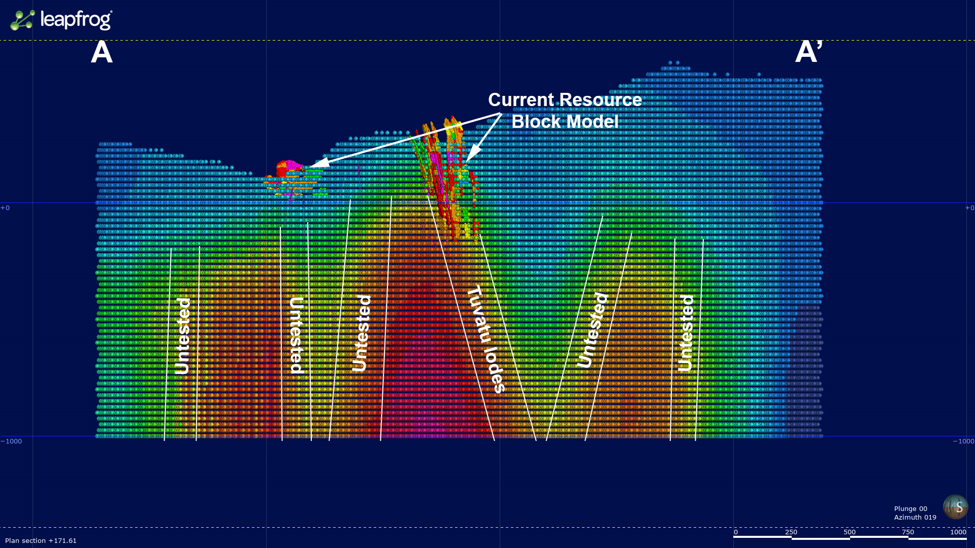

Lion One’s results from geophysical survey

Lion One Metals released results from an advanced CSAMT geophysical survey conducted on its Tuvatu gold project in Fiji. The results couldn’t have pleased management more, as they seem to have revealed structural controls behind the known gold lode mineralization.

This is important not only because the survey shows significant potential extensions to those known lode systems, but also a number of large-scale new targets to be tested. I urge you to read Lion One’s news release on this survey, as it’s very comprehensive and detailed, with a number of geophysical sections that clearly show the current mineralization along with the new targets.

I’ve always been impressed with the Tuvatu deposit and, as many of

you know, the potential of Fiji in particular for mineral exploration.

In detailed discussions with Lion One management in Vancouver recently, I

was struck by the potential for the newly acquired Navilawa caldera

adjoining the original Tuvatu tenement.

Importantly, the caldera represents an alkaline gold system, a fact that

opens the possibility of a truly world-class gold deposit.

Just-released sampling results from a six-kilometer-long corridor

northeast of Tuvatu support the notion that drilling on Navilawa will

eventually turn up more lode gold. The channel sampling focused on an

area within three kilometers north and northeast of Tuvatu and was

highlighted by uber-high-grade results such as 35.3 g/t gold over 0.45

meters on the Banana Creek target, 83.6 g/t gold over 0.45 meters on the

Biliwi target and 35.8 g/t gold over 0.60 meters on the Matanavatu

target.

Foreign Investor to Reopen Mount Kasi Gold Mine

Newcrest closes $60m sale of Gosowong mine in Indonesia

Newcrest (ASX: NCM) announced Wednesday the finalized sale of 100% of Newcrest Singapore Holdings Pte (NSH) to Indotan Halmahera Bangkit (Indotan) for A$90m, (about $60m) of which A$60m has already been received and the remaining A$30m is payable in 18 months.

NSH owns 75% of PT Nusa Halmahera Minerals (PT NHM), which operates the Gosowong mine in Indonesia. The move comes after Joko Widodo’s government issued a mandate in 2018 stating that major mines such as Gosowong or Freeport-McMoRan’s (NYSE:FCX) Grasberg have to be at least 51% owned by Indonesian companies.

The Gosowong gold operation is located on Halmahera Island, about 2,450 kilometres northeast of the national capital, Jakarta. It is a gold (epithermal) deposit with additional occurrences of silver.

The Gosowong mine produced 190,000 ounces of gold at an all-in sustaining cost (AISC) of $1,099/oz for the 2019 financial year.

Newcrest expects to recognize a A$44m loss on divestment of its 75% interest after taking into account the sales proceeds less written down value of the assets sold and transaction costs.

K92 Mining’s Latest Drill Results From Kora

- Drill

Hole KMDD0167 records bulk intersection of 30.1 m at 22.7 g/t Au, 5 g/t

Ag and 0.54% Cu (23.6 g/t AuEq). The bulk intersection comprises

multiple veins, including:

° K1 of 10.0 m at 17.6 g/t Au, 1 g/t Ag, 0.10% Cu (17.77 g/t AuEq);

° Kora Link of 5.1m at 8.5 g/t Au, 4 g/t Ag, 0.44% Cu (9.24 g/t AuEq);

° K2 of 10.1 m at 45.7g/t Au, 12 g/t Ag, 1.29% Cu (47.8 g/t AuEq). - Drill Hole KMDD0177 records multiple intersections including 14.60 m at 5.96 g/t Au, 35g/t Ag and 3.32 % Cu (11.48 g/t AuEq).

- Drill Hole KMDD0175 records multiple intersections including 8.08 m at 20.01 g/t Au, 13 g/t Ag and 0.87% Cu (21.50 g/t AuEq) plus 8.50 m at 10.83 g/t Au, 52 g/t Ag and 3.81% Cu (17.33 g/t AuEq).

- Drill Hole EKDD0003A records multiple intersections including 8.00 m at 31.74 g/t Au, 7 g/t Ag and 0.52% Cu (32.63 g/t AuEq).

- Drill Hole KMDD0153 records multiple intersections including 3.70 m at 48.57 g/t Au, 177 g/t Ag and 1.31% Cu (52.82 g/t AuEq) and 5.69 m at 6.62 g/t Au, 6 g/t Ag and 0.14% Cu (6.92 g/t AuEq, 2.67 m true width).

- Drill Hole KMDD0198 records multiple intersections including 8.74 m at 21.58 g/t Au, 3 g/t Ag and 0.74% Cu (22.74 g/t AuEq).

VANCOUVER, British Columbia, Feb. 20, 2020 (GLOBE NEWSWIRE) — K92 Mining Inc. (“K92” or the “Company”) (TSX-V: KNT; OTCQX: KNTNF) is pleased to announce results from the continuing diamond drilling of the Kora North Extension of the Kainantu gold mine in Papua New Guinea.

The results for the latest 25 diamond drill holes completed from both surface and underground into the Kora North deposit are summarized in Table 1 below. The results include multiple high-grade intersections, with the vast majority reported outside the boundaries of the October/2018 Resource estimate. The intersections demonstrate the high-grade and continuity of known mineralization beyond the resource along strike to the south, up-dip and down-dip.

Step-out drilling to the south has extended the known mineralized southern extents by ~225m, recording multiple high-grade intersections. KMDD0175, drilled ~150m south of the Oct/2018 resource, recorded 8.08 m at 20.01 g/t Au, 13 g/t Ag and 0.87% Cu (21.50 g/t gold equivalent (“AuEq”), 2.86 m true width) and 8.50 m at 10.83 g/t Au, 52 g/t Ag and 3.81% Cu (17.33 g/t AuEq, 2.63 m true width). Step-outs more proximal to the Oct/2018 resource also recorded high-grade intersections including KMDD0198 recording 8.74 m at 21.58 g/t Au, 3 g/t Ag and 0.74% Cu (22.74 g/t AuEq, 6.80 m true width). Our most southern hole to date KMDD0177, ~225m south of the Oct/2018 resource, recorded 14.60 m at 5.96 g/t Au, 35g/t Ag and 3.32% Cu (11.48 g/t AuEq, 6.12 m true width) and importantly, intersected massive bornite mineralization (See Figure 4). The bornite mineralization is indicative of potential increasing proximity to one or multiple heat sources (to the south and/or to depth).

These drill results also continue to demonstrate the potential for high-grade mineralization up-dip and down-dip of the Oct/2018 resource, including a localized improvement in grade from increased drilling density in several areas. KMDD0153, drilled ~75m below the Oct/2018 resource, recorded 5.69 m at 6.62 g/t Au, 6 g/t Ag and 0.14% Cu (6.92 g/t AuEq, 2.67 m true width) and 3.70 m at 48.57 g/t Au, 177 g/t Ag and 1.31% Cu (52.82 g/t AuEq, 1.91 m true width). KMDD0159, ~50-100m below the Oct/2018 resource, recorded 2.73 m at 14.74 g/t Au, 18 g/t Ag and 0.14% Cu (15.18 g/t AuEq, 1.24m true width) and 1.97 m at 6.33 g/t Au, 298 g/t Ag and 3.58% Cu (15.60 g/t AuEq, 1.28m true width). Up-dip of the Oct/2018 resource, surface drill hole EKDD0003A recorded 8.00 m at 31.74 g/t Au, 7 g/t Ag and 0.52% Cu (32.63 g/t AuEq, 4.06 m true width), ~100 m up-dip from the Oct/2018 Resource.

Additionally, the results further demonstrate the potential for bulk mining, with KMDD0167 reporting a bulk intersection of 30.1 m at 22.7 g/t Au, 5 g/t Ag and 0.54% Cu (23.6 g/t AuEq, 29.7m true thickness). The intersection occurred where the Kora Link vein connects the K1 and K2 veins and highlights the potential for larger scale transverse long hole open stopes at Kainantu. Total drill metres after the Oct/2018 resource has increased +240%, which has enhanced K92’s understanding of Kora Link structures, including showing more structural continuity, particularly persistency vertically, than previously known.

Long sections of K1 and K2 showing the location of the latest drill holes are provided in Figures 1 and 2 respectively. Long section showing Kora North drilling to date is provided in Figure 3.

(Gold Equivalent (AuEq) is calculated using copper price of US$2.90/lb, silver price of US$16.5/oz and gold price of US$1,300/oz.)

John Lewins, K92 Chief Executive Officer and Director, stated, “The reported results continue to demonstrate the high-grade pedigree, continuity and the strong extensional potential of Kora North. Step-out drilling to the south has extended known Kora North mineralization by over 200 metres below the known Kora resource, with multiple high-grade intersections recorded. One of the most recent holes drilled, KMDD0177, intersected massive bornite mineralization which may be significant in providing a vector towards the potential heat source. Drilling up-dip and down-dip has also been very encouraging with multiple high-grade intersections recorded and increasing drill density.

Since the October 2018 Resource, Kora North drill metres have increased by +240%, which has provided an enhancement to our understanding of the system, including the Kora Link structures. These structures are emerging as being more continuous than previously known, are vertically persistent, and represent a potential opportunity for high productivity, transverse long hole open stoping.

While we are now in the process of updating the Kora North resource to incorporate all of the results reported to date, we continue our drilling program with five diamond drill rigs active on the mining lease. These will shortly be supplemented by three new diamond drill rigs due on site in 2Q 2020. The two surface rigs and one underground rig will not only provide an increase to our rate of exploration but also our capacity to test new targets, some of which we expect to drill in the near term.”

Where Is the Gold Rush Leading to?

Lately we have, with increasing frequency, been witness to fairly significant events. However, those involved in them usually attempt to hide what is happening behind a wall of secrecy.

For instance, at the end of last year, the process of moving Polish gold reserves from Great Britain back home was completed in secret. G4S plc, a UK security services company, helped Warsaw transport 8,000 bars made of the precious metal (weighing 100 tons). Polish gold was first brought to London during the Second World War. Several dozen tons of the precious metal as well as a collection of gold coins were transported to the UK capital to prevent the Third Reich from getting hold of this treasure. However, once the war ended, Warsaw decided not to repatriate its reserves under the pretext that Great Britain was one of the world’s most reputable storage centers for precious metals. But now Poland’s stance on the issue has completely changed for a number of reasons. The National Bank of Poland has attempted to explain this move with a statement that they needed to “diversify the storage locations of their gold resources in order to limit geopolitical risk, which could result, for example, in losing access to or restriction of the availability of gold resources held abroad”.

Still, Brexit must have had quite a significant effect on Warsaw’s decision, since leaving the European Union meant that the United Kingdom officially lost its status as Europe’s key financial hub. After all, it is well known that gold is usually stored in the vicinity of a financial market where it can be traded in order to save on transportation costs, because insurance for shipping precious metals is extremely expensive. Only during exceptional economic and political circumstances is the decision to spend many millions on moving gold reserves made. Hence, for the past century, many nations of the world chose to store this precious metal primarily in Great Britain and the United States.

It is also possible that Poland’s decision to bring back its gold reserves from London stemmed, to a certain extent, from the European Central Bank’s refusal, on account of the looming Brexit, to renew the Central Bank Gold Agreement with the Bank of England upon its expiry in 2019 (in the past, such deals had been brokered on a daily basis at the London headquarters for Rothschild Bank on St. Swithin’s Lane). Hence, we can predict that such a move will finally free the global precious metals market from a century-long control and manipulation over it by the Bank of England and by the Rothschild’s dynasty.

As for Warsaw’s completed operation to repatriate its gold, it is essential to point out that many other countries had begun to take similar actions more and more often starting in 2012. For instance, at the time, Venezuela announced that it would bring back all of its gold (i.e. 160 tons worth approximately $9 billion) home. This happened after the then President Hugo Chávez stated that the bars had to be returned to Venezuela because they could one day turn into Washington’s “hostages” and thus an instrument of pressure. And six years later, this is exactly what transpired. London and Washington blocked the repatriation of Venezuela’s gold.

It is also important to remind our readers that, in addition to the incident with Venezuela, Western “keepers of gold” have used the precious metal as a political tool on more than one occasion over the past century. For instance, after numerous delays in returning France’s considerable gold reserves (stored in the United States after the start of World War II), Washington was finally compelled to fulfil the French request in 1965 as a result of actions taken by President Charles de Gaulle, who demanded that the gold be exchanged for relatively worthless US dollars which had accrued in the Banque de France. However, we all know what happened next, student protests in France led to the resignation of Charles de Gaulle as President in 1969. At the time, several French analysts believed that the United States was responsible for what had happened.

Then other countries followed in France’s footsteps. Germany, Japan, Canada, Australia and a number of other nations similarly demanded that US dollars be exchanged for their gold. And these countries asked for more of their reserves back in comparison to France. Forced to comply with these demands, the United States was visibly going bankrupt and Fort Knox’s vaults were growing empty by the minute. In March 1968, Americans cancelled the direct international convertibility of the United States dollar to gold. In fact, in June 1971, all of USA’s reserves were worth only 10 billion US dollars!

The West used gold as a political tool and a form of “punishment” yet again in 1982 when the dollar price of this precious metal (a key export for Moscow at the time) mysteriously plummeted from $850 per ounce to $300 per ounce as a result of USSR’s invasion of Afghanistan.

At present, US gold reserves are continuing to be depleted. The reasons for such a state of affairs are obvious: the rising federal funds rate; pressure on the Euro and other currencies; greater geopolitical risks; trade wars initiated by Washington, and U.S. sanctions levelled against the rest of the world. In such a climate, even USA’s allies are trying to reduce their dependency on the US dollar.

In 2014, the central bank of the Netherlands transported 120 tons of gold from New York to Holland, thus leaving 30% of this precious metal in the United States instead of 50% as before. Amsterdam attempted to explain this move with a statement that keeping half of its gold reserves in one place (a prudent step during war) was unwise and impractical in current times. At the same time, a number of analysts are confident that the Netherlands will continue to repatriate its gold from the United States in order to mitigate risks associated with unpredictable actions taken by President Donald Trump.

In 2012, Germany also started removing its gold from the United States (which was stored there since the end of World War II). Approximately 300 tons of this precious metal have already been returned to the vaults of the Bundesbank (the central bank of the Federal Republic of Germany) in Frankfurt.

In 2018, Turkey completed the process of transporting 27.8 tons of its gold from the United States back to its national vault.

It is important not to forget that having gold reserves is an important means of protecting oneself from crises and economic upheavals. 2019 was a year of paradigm shifts that will have far-reaching consequences for global financial markets. The US dollar is no longer the only viable global currency or the preferred means of storing funds for a rainy day. Instead, nowadays, central banks all over the world are beginning to revert to the oldest of currencies — gold, as no one has any doubts about its value.

Fewer nations trust the United States these days since there are absolutely no guarantees that Washington, which has more and more often resorted to the use of financial pressure, will not freeze the assets of “inconvenient” countries.

Hence, practically all the nations with advanced economies have actively begun buying gold on global markets recently. For central banks of many developed countries savings in gold are a safe haven asset that can be utilized during a global financial crisis. After all, the reason why a nation, in any part of the world, keeps gold reserves is to firmly support its national currency and to ensure its liquidity (reflected by the amount of this precious metal stored in its banks). The bigger the nation’s gold holdings, the more independent its economy is. After all, the precious metal has always been an effective means of payment world-wide.

According to a survey conducted by PricewaterhouseCoopers (a tax and consulting services network) in preparation for the Forum in Davos, pessimism felt by top managers all over the globe regarding the prospects of economic growth is at record highs. Problems with the global economy become exacerbated faster than hopes rise, and as the number of such issues increases, the trust in the U.S. dollar falls.

Hence, it is not surprising that gold is being accrued all over the world nowadays. The purchase of this precious metal by central banks is a stable trend, lasting for the past 10 years, and it resulted from the global crisis of 2008-2009. And judging by the rate at which nations are accruing gold, we could conclude that the central banks of Germany, France, Italy, Russia, China. Turkey and other countries are expecting the next global financial crisis soon and are preparing for it. In fact, many think tanks and media outlets have been doggedly warning the public about the upcoming economic downturn.

Vladimir Odintsov, expert politologist, exclusively for the online magazine ‘New Eastern Outlook’.

Also on this topic

US Middle East “Peace Deal” Designed to Perpetuate Conflict

Iran – USA: Aggressive American Politics

Could the Latest Outburst of Ankara’s Temper Lead to Escalation in Syria?

Libyan “Knot” in France–Turkey Ties

Armageddon, Determinism and Rage

Trump Policy Wangle in Munich: Human Beings Reduced to Smelly Sauce

Lion One Metals: Site Visit Part 1

So, I just got back from a site visit to Lion One Metals down in Fiji yesterday and I thought that I would update my case for the company based on the latest information in the first part of the site visit series. First of all, the site visit was beyond awesome and I am very grateful that the company was so kind to cover all the expenses in order to get me down to Fiji. In my experience, the people I meet is the best part of any site visit and this time was no exception. I might be old fashioned but I usually have a need to like the people involved in a company in order to invest any meaningful amount of my money. I want to want the people involved to succeed and I would certainly not have Lion One on as a sponsor if I didn’t like the people involved and believed that they were honest people that wants to succeed WITH shareholders (Investing Truth: People, people, people). Since I am no geologist nor a mining engineer I had tonnes of questions and everyone was more than happy to explain things (sometimes over and over hehe). I also ran into some problems during the return trip from Fiji and the company was quick to help me out so I could get back home (Much appreciated!).

Ps. If anyone wants to know what paradise looks like, then go visit Fiji…

The Hedgeless Horseman standing on an extinct volcano:

As per usual, at least nowadays, I will start off with some comments on my investing strategy and how that ties into Lion One which has been a core holding of mine for quite some time.

Setting The Scene

You will see a lot of newsletter writers etc talk about what juniors COULD go up a lot. Such content mainly taps into the greed aspect of human nature, which is neither surprising nor factually incorrect. But, I could list hundreds of juniors that COULD go up a lot, and still it wouldn’t mean much. The simple reason for this is that all juniors pretty much has the potential to go up a lot. With that said, I don’t think that angle is optimal when it comes to investing because the COULD usually has a 1% chance of happening in reality.

As many people would probably have noticed by now I tend to focus on the ones that SHOULD go up instead. This is probably the greatest transformation that I have done personally, over just the past year or two, when it comes to investing strategy. Nowadays I simply rather pay up for something that “looks” expensive, compared to the crappy run of the mill juniors, if I believe that a revaluation is PROBABLE instead of POSSIBLE. Furthermore I think it is important to consider the fact that it easier to evaluate junior miners as a non-geologist the more advanced and de-risked an asset is. The average one asset exploration junior will probably have nothing although it could have something. Trying to figure out the chance of success at such an early stage is something I pretty much find impossible and I would only invest in such ventures if the people behind it was world class since such a stamp of approval is enormously more valuable than my personal guesstimate.

In other words: SHOULD > COULD

… Even if that usually means that the super blue sky case for a SHOULD play is lower than that of a COULD play. This just boils down to the law of greater numbers. A $10M MCAP company has a theoretically “easier” time to go to $100 M than a $100M MCAP company has to go to $1B. But with that said, I believe that an ALREADY SUCCESSFUL $100M company has a better chance of revaluing higher than the $10M pure potential play in a given time frame. Why? Because the $100 M company already has something and might have a lot of room left to grow while the $10 M company has a very slim chance of even finding something that would be worth anything in reality.

Now, given how greed and the law of big number works, you will often hear that companies are cheap just based on their MCAP or god forbid their actual share price. This is a totally irrational way to go about it in my humble opinion.

What makes something cheap is not dictated by PRICE alone, but what PRICE you pay for the intrinsic VALUE of a company. This is just classic Fundamental Value Investing but it really seems to be a rare way of thinking in the junior mining space. All of the factors that I just mentioned are the basis for why I have been harping on about why I think banked success has been, and still is, on sale.

Another example of confusing PRICE with VALUE is the fact that a lot of people are very reluctant to buy a stock just because it has run up on the back of a discovery whatever. This isn’t really a surprise since nobody wants to feel like one has already “missed out on the opportunity”. Basically it’s a common, automated, human reaction to not want to buy something that has gone up say 100% because one is afraid of being “the sucker”. But if one thinks about it, it’s obviously much more complicated that that…

Let’s say a random junior explorer has a 1% chance of finding a deposit that will some day turn into a profitable business and it is trading for $10M. If said junior then makes a “discovery”, and the price of the company proceeds to jump 100%, is it automatically a buy at that point? Well, what if the chance of success jumped from 1% to 20% due to the discovery hole? That’s a 20X increase in chance of success but only a 2X increase in price.

A crude example:

Company X has a 1% chance of finding something that will be worth $500 M at the end of the day and is trading for $10M.

The actual Expected Value for company X (pre-discovery) is $5 M but it’s selling for $10 M.

Then lets say that company X drills a couple of good holes and is on to a discovery which puts the chance of success closer to 20%

That would mean that the updated Expected Value of the company is $100 M, which is 10 times more than what the company was selling for prior to the discovery.

If the share price, and thus the price of the company, jumps 100% then it’s only up to $20 M.

In other words, it would be a much better buy at $20M after a 100% rise in share price (post-discovery) than it was at $10M prior to discovery.

… It was in fact a BAD buy at $10M but a GREAT buy at $20M in this example. Yet, it is my humble opinion that a minority of people in the junior mining space are even cognizant of this simple truth.

Simple mental mistakes like this is why I spend 95% of my time and energy on looking for de-risked companies, which already have some degree of success banked, because they will more often than not be cheaper than the juniors that are selling for 1/10th of the price (from an Expected Value stand point). If one goes back and read my articles on investing over the last 6-months or so, one would probably notice how I have tried to communicate concepts such as this.

Don’t get me wrong, I am looking for home runs (aka 10+ baggers). I just think that there is a higher chance of finding them in the companies that look expensive (on surface) compared to the pure potential micro caps that are trading for 1/10th to 1/20th of the former companies market cap.

Investing Truths

- A company is only a growth company if it HAS SOMETHING TO GROW

- A junior that has yet to find anything of value only has the POTENTIAL to become a GROWTH company.

The Case For Lion One Metals

Lion One Metals has been a core position of mine for over a year and it all goes back to everything I just discussed and have discussed in articles over the past year. It’s a company with banked success already and which I also think has a long run-way for growth.

Some of the success which is already banked:

- Serially successful management team that has done it before

- Mining Lease

- Good Jurisdiction

- Good Infrastructure

- ~1Moz of resources

- Controls an entire Alkaline Gold System (10Moz+ potential)

- PEA based on a postage stamp of the footprint with very high IRR

- Cashed up

… How many junior do you think fit that description? I personally can’t think of a single one.

Almost every Major Mining Company has an Alkaline Gold System as a cornerstone asset. Barrick has Porgera, Newmont Goldcorp has Cripple Creek, Kirkland Lake has Macassa and Newcrest has Lihir. Most of these mines have been mined for decades and have provided an immense amount of value. These are all giant mines and every Major mining company desperately wants large and long lived assets such as this. These systems are incredibly rare and I think Lion One Metals is the only junior in the world that currently controls 100% of such a system:

The neighboring Vatukoula mine is also an Alkaline Gold system and has been mined for over 80 years if I remember correctly and it’s still being mined today. Just think about the cumulative value that these mines will have created until the day that they are finally mined out? We are talking about company making operations that could sustain a gold producing business over decades, which is becoming rarer and rarer by the day. It’s so rare that most of the wheeling and dealings by the majors lately has just been about reshuffling control over legacy mines. These types of deposits are simply unique. This is an important point. Few juniors will ever found anything that anyone would put into production, even fewer will ever hope to find anything that could become a cornerstone asset for a mid tier or major producer.

So OK, Lion One already has a small deposit on a mining lease that could already be worth close to Lion One’s Enterprise Value of US$157 M. That’s a good START since it means that there is a sturdy base case in place. But in order for Lion One to be a core HODL case for me I want a long run-way to boot and I would argue that the company has a very long run-way.

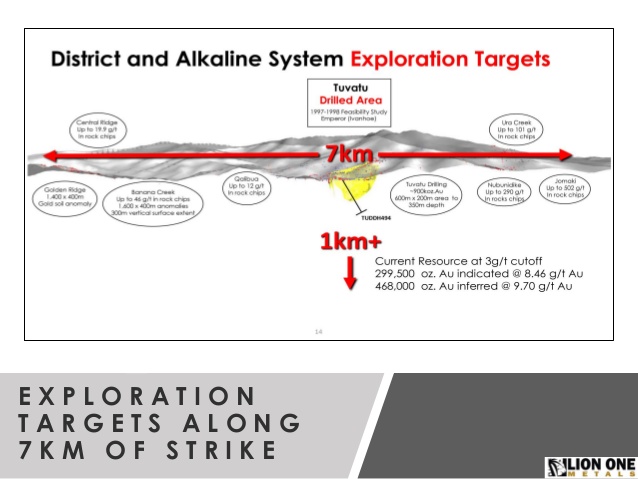

The next slide shows the Mining Lease, the current (shallow) Tuvatu Resources and outcropping Monzonite (which is the host rock):

… The slide gives a sense of how big the lateral pie might be. This next slide highlights this as well:

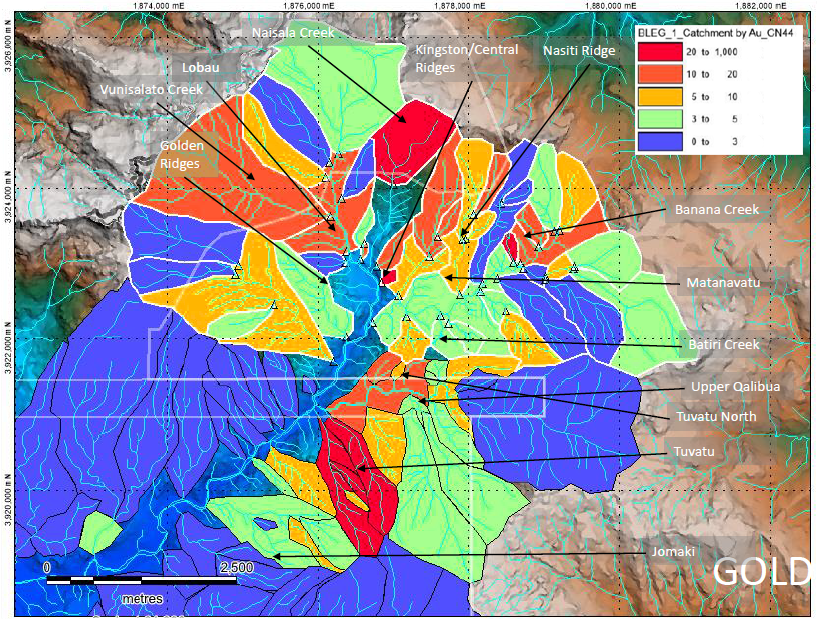

… So surface sampling and geological context sure is hinting that the gold system is laterally way more extensive than what has been explored to date. Then we add on the BLEG sample results:

… Sure enough, the BLEG data is suggesting that the lion’s share (pun intended) actually seems to be to the north. Now, let’s look at the Potassic Alteration which is another clue as to where alkaline fluids have penetrated the rock:

… Yet another clue which further confirms all the previous clues. The thing is that all these slides have been highlighting the lateral potential of this Alkaline Gold System. Then we add on the fact that systems such as this can extend for over 1km at depth…

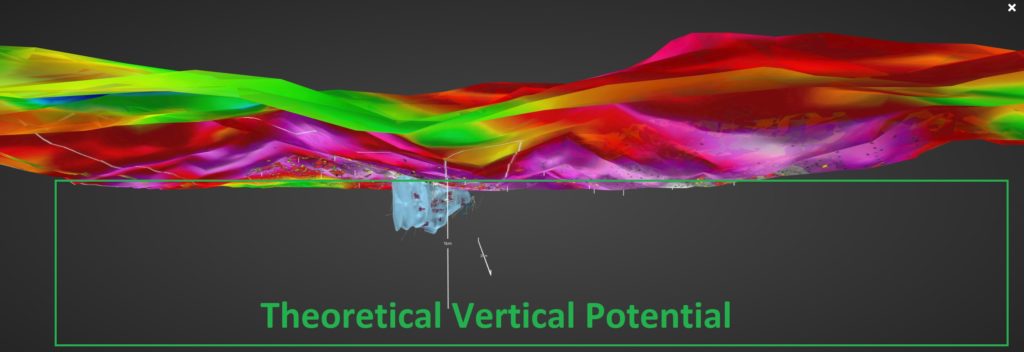

… OK, so it has been said that theoretically the Tuvatu Deposit with it’s countless lodes could extend further down. In order to “confirm” this, the company has been doing CSAMT surveys led by the specialist Tom Weis, who also did the CSAMT surveys for Irving (which is already reaping rewards). Lo and behold, the initial data from the CSAMT surveys is suggesting that the depth potential is indeed fully on the table:

… Note that the slides above are from the area around the Tuvatu Deposit which is of course just one part of the entire Navilawa Caldera. Now play with the thought that the Tuvatu deposit could extend say 3X+ times deeper and that there might be multiple more lode clusters in the surround area as suggested by the CSAMT surveys. Then play with the thought that the lateral extend of the system could be up to 7km and that the northern part might even be better. What kind of absolute potential are we talking about then? I don’t want to put numbers on it but consider that the Tuvatu Resources is around 1Moz and do the math. Furthermore, the PEA on that “postage stamp” suggests a NPV of around US$150 M at a gold price of $1,500 (Reminder: Lion One’s current Enterprise Value is US$157 M). Even though PEAs are usually overly optimistic I think it’s fair to say that Lion One is one of those cases where one is not paying much more than the value of the bird in the hand and one gets all the birds in the bush for free. This kind of highly asymmetric risk/reward is what makes this company one of the few “no brainers” in my mind. This wouldn’t be possible if the market wasn’t confusing uncertainty with risk and not effectively pricing in the exploration potential. Sure, the exploration upside is uncertain in terms of range… Is Navilawa hiding 2Moz, 5Moz or 15Moz+?. Impossible to know at this time but not pricing in much of the upside because the upside spectrum is wide is irrational to me (hence the opportunity in place IMHO).

Conclusions

BLEG sampling, rock chip sampling, legacy mining, Alkaline Gold System characteristics as well as geophysics are all pointing to exploration upside being probable and not just possible in my opinion. Each (additional) one of these aspects are exponentially enforcing/confirming all the other ones. A single aspect could be considered an anomaly but together they become a pattern. Again, there is a big difference between possible and probable upside scenarios, and they should not be priced the same As this theoretical pattern probably/hopefully gets translated into reality by the drill bit, uncertainty will decrease, and the (in my opinion) overly discounted theoretical potential should start to be reflected in the share price with time. Given that Lio One has stated that they are scrambling to get more rigs on site I can see a potential revaluation of this venture happen sooner rather than later. In fact, I think all that is needed is a few solid hits which confirms the very encouraging CSAMT survey results could light the stock on fire in a hurry, since that would mean that we would have proof of concept.

… This is exactly what I am looking for in a junior. A de-risked project, with a margin of safety and a lot of room for growth.

I think Lion One could explore the Navilawa Caldera for 10 years and still have lots left to explore. The system looks THAT big. However, I think this is already become apparent and I would be surprised if a larger entity would not have taken the company over within say 2-3 years. Majors miners are OK with taking operational risk, but they hate uncertainty. In other words, they are happy to pay up for all the de-risking efforts done by a junior in terms of exploration. This is exactly why I like these kinds of juniors. The ones who have PROBABLE growth ahead that a major will gladly pay up for, later.

I personally hope to own Lion One all the way up to a natural exit (a take over) so it doesn’t matter to me what the price does today or tomorrow. If a natural exit would to occur, I would not be surprised if it would come at a premium at all time highs, which is why Lion One is one of those rare companies that I am happy to HODL through out the short and medium term volatility.

To Sum Up

My case for having Lion One Metals a core position is actually rather straightforward (I like to look for simple “no brainers” if you haven’t noticed):

- Great people involved

- Increases the chance of (further) success

- Good jurisdiction

- Increases the intrinsic value and the likelihood of a take-over

- De-risked project which provides a margin of safety

- Decreases downside risk

- Enormous blue sky

- Lots of upside potential and a real shot at a world class asset

- Cashed up

- Lots of tools to work with and create further value

… Only a tiny fraction of juniors could say the same.

Lastly: Do your own due diligence and make up your own mind, as I have. We are all responsible for our own investment decisions and one should never risk capital that one can’t afford to lose. This is a high risk/high reward business.

Bonus picture: Into the belly of the beast…

Tuvatu

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Lion One Metals which I have bought in the open market and am thus biased. Lion One Metals is a passive banner sponsor on my site and the company was kind enough to pay for the trip. )

Best regards,

The Hedgeless Horseman

Newcrest, Harmony overcome Wafi-Golpu legal block

Newcrest Mining and Harmony Gold are set to resume talks for the Wafi-Golpu gold-copper joint venture (JV) project in Papua New Guinea (PNG) after delays in securing project permits.

The JV partners scored a win as PNG’s national court in Lae withdrew a court order to stop judicial proceedings temporarily.

The order was originally requested by the governor of the Morobe province, who said he would be consulted during negotiation of the JV deal.

The national and Morobe Provincial Government had unresolved legal proceedings regarding the internal distribution of PNG’s economic interests in the Wafi-Golpu project, said Newcrest chief executive Sandeep Biswas during his speech at the company annual general meeting last year.

“The PNG Minister for Mining recently (advised) the Wafi-Golpu joint venture (WGJV) partners that the state of PNG had withdrawn its support for the memorandum of understanding and instructed its lawyers to take steps to set aside the stay order and terminate the judicial review proceeding,” Newcrest stated.

“As a consequence, the stay order restricting the WGJV partners from engaging in discussions with the state of PNG has been lifted.

“Newcrest, together with its WGJV partner Harmony, look forward to re-engaging with the state of PNG and progressing discussions on the special mining lease for the Wafi-Golpu project.”

Newcrest and Harmony each own 50 per cent interest in the Wafi-Golpu project through the JV.

Wafi-Golpu has an ore reserve of 5.5 million ounces of gold and 2.5 million tonnes of copper.