Feb 18, 2017 | Seeking Alpha

Summary

Newcrest Mining produced 1.2 million ounces of gold in the first half of FY 2016, reaffirming the company’s position amongst senior producers.

Newcrest was profitable ànd free cash flow positive.

The free cash flow was used to repay debt, and the net debt/EBITDA ratio fell to 2.1 (and NCM remains on track to meet its target of 2).

I’m not convinced the Wafi-Golpu project should be built once the feasibility study will be completed, as the return will be quite low.

Introduction

Newcrest Mining (OTCPK:NCMGF) and (OTCPK:NCMGY) is one of the larger gold producers in the world, but due to the fact the company only has a (decent) listing on the Australian Stock Exchange, it doesn’t get the recognition it deserves. Newcrest has recently released some updates and I figured this is an excellent starting point for my due diligence.

NCMGF data by YCharts

As Newcrest’s primary listing is on the ASX, I’d recommend you to trade in the company’s shares in Australia, as trading is much more liquid down there. Newcrest is listed with NCM as its ticker symbol and the average daily volume is 4.4M shares. The current market capitalization is $8.4B, so it’s definitely not a small company.

Newcrest is a major gold producer but doesn’t stand up from the crowd

Indeed, when someone is discussing ‘senior gold producers’, one usually comes up with Barrick Gold (NYSE:ABX), Goldcorp (NYSE:GG) and Newmont Mining (NYSE:NEM). Perhaps some people will also add Agnico Eagle Mines (NYSE:AEM) and Kinross Gold (NYSE:KGC) to that list, but that will be it. I dare to bet only a single-digit percentage of North American resource investors will name Newcrest Mining as well.

And that’s a pity, as the company produced approximately 1.2 million ounces of gold (as well as almost 85 million pounds of copper) in the first six months of its financial year 2016. This resulted in a total revenue of $1.55B which is approximately 13% lower compared to the first semester of the previous financial year. That’s a bummer but absolutely not unexpected, given the recent gold and copper prices.

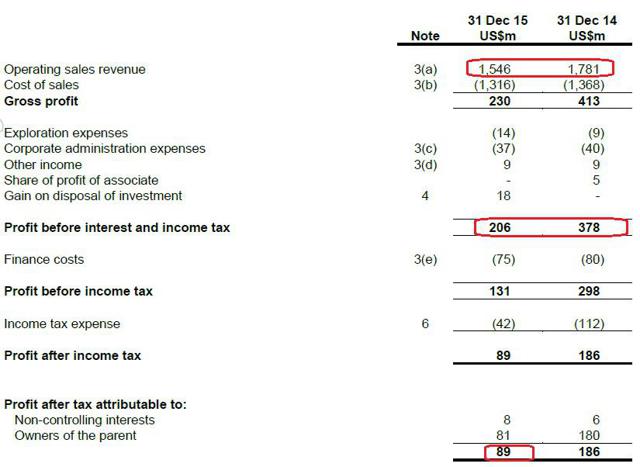

Source: financial statements

The gross profit was basically halved to $230M but as Newcrest was able to nip its other expenses in the bud, the pre-tax income was still $206M resulting in an after-t ax profit of $89M. That’s not much, and it really shows why it’s important to reduce the company’s outstanding debt as fast as possible, as approximately 40% (!) of the EBIT gets ‘eaten away’ by interest payments, and that’s pretty brutal!

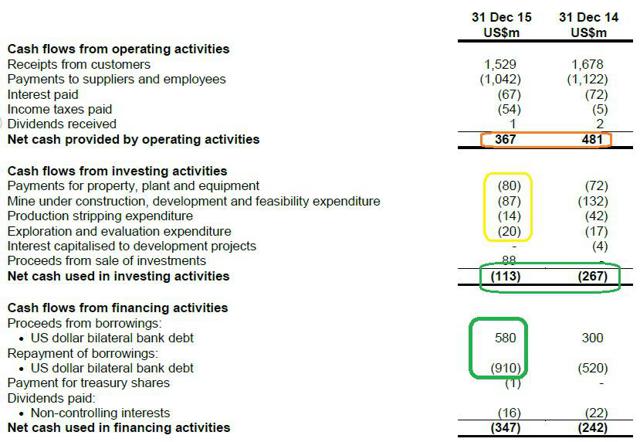

Source: financial statements

A net income of $89M isn’t really too exciting, but the cash flow statements are providing a more optimistic view on the company’s performance. Newcrest generated $367M in operating cash flow and after deducting all the capital expenditures, the free cash flow in the first half of the financial year was approximately $166M (which is almost twice as high as the net income), so that already is a better result. The entire free cash flow (and an additional $180M from selling investments and the previously existing cash position) was used to reduce the net debt which stood at $2.65B for a net debt/EBITDA ratio of 2.1.

That’s a decent achievement, and Newcrest remains on track to reach its target ratio of 2 before the end of the financial year, as it still isn’t paying a dividend and is openly stating reducing the net debt is its primary concern.

The debt situation is improving, and that’s necessary as Newcrest has big plans

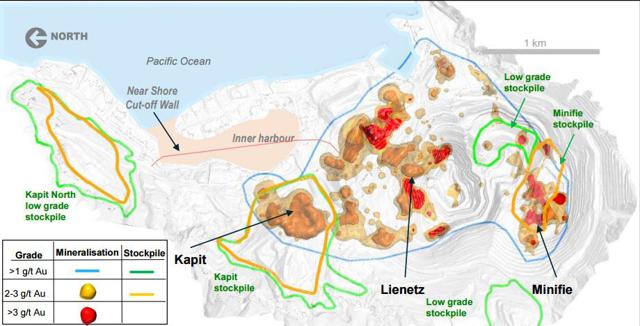

Newcrest will have to make sure it has some financial flexibility, as the company has plans for both Lihir and Wafi-Golpu. At Lihir, the company is currently planning a revised pit outline which should result in a reduced capital expenditure, whilst it has also provided an update on the feasibility study and pre-feasibility study for the Wafi-Golpu project.

Source: company presentation

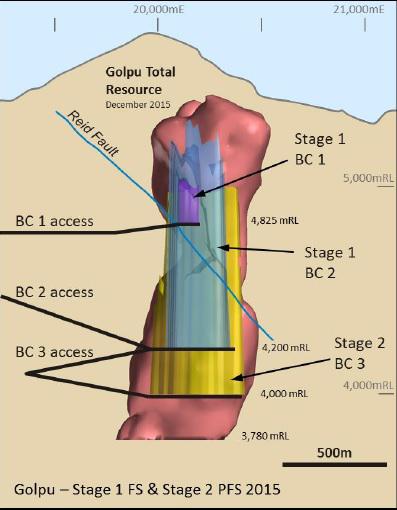

In a first development phase, Newcrest is planning two block caves at the Golpu resource, which contains in excess of 9 million ounces of gold as well as 9 billion pounds of copper and 17 million ounces silver. Unfortunately Newcrest hasn’t indicated the expected initial capex but as the IRR will be just 15% and as the payback period will be 10 years from the start of the earthworks. The NPV of the project is $1.1B which is pretty good, but don’t forget that a) as long as Newcrest doesn’t share the parameters used to determine this NPV (capex, gold price, copper price, discount rate…), that number is basically meaningless to me. Also keep in mind Newcrest owns just 50% of the property (and could be diluted down to a 35% ownership should the PNG government choose to exercise its rights to buy a 30% stake in the property).

Source: press release

So if Newcrest is really serious to move ahead with Wafi-Golpu, it will likely have to find a lot of money and having reduced its net debt by the time it needs to secure funding will help a lot.

That being said, I think Newcrest might also be looking at some other companies and projects. In Australia for instance, Gold Road Resources (OTCPK:ELKMF) recently released an impressive pre-feasibility study on its Gruyere gold project in Western Australia, and I think this might actually be something Newcrest could be really interested in, further down the line.

Other major companies are selling assets to reduce their debt load, but Newcrest could be in a position to try to acquire some projects by using its own shares as a currency. But again, a healthy financial situation will be priority number one, as everything starts with a healthy balance sheet.

Investment thesis

Newcrest is often overlooked by resource investors, but if the company continues to make the right steps to reduce its debt load, it could become an attractive alternative to Barrick Gold and Newmont Mining. I currently have no position because my main fear is to see the company getting involved in another high-capex low-return projects during the current downcycle, and I’m not sure aggressively advancing Wafi-Golpu is in the company’s best interests right now.

Sure, I’m in favor of completing all studies at the PNG project, but I would hold off on committing to construct the mine in the current investment climate. A better solution for Newcrest could be to find a smaller bolt-on acquisition with a lower initial capex.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.