Heading into 2018 the world’s 50 largest listed firms are worth a collective $896 billion, adding $141 billion in combined market capitalization year-to-date, with the bulk of those gains recorded since July.

Go back to the start of the mining industry’s upswing around 18 months ago and $227 billion of wealth has been created for shareholders of the MINING.com Top 50.

The top 10 make up more than half the sector’s market value and after underperforming the rest of the field during the first half of 2017, the big diversified and base metals companies caught up rapidly.

Of the gains since end-June nearly 65% have accrued to the top 10 largest mining companies. Year-to-date just two companies – Vale and Glencore – constitute 27% of market capitalization growth.

Gold companies have had a tough go of it this year with top producers Newmont Mining and Barrick Gold falling out of the top 10. Newmont overtook Barrick as the world’s most valuable gold miner this year, but was pushed out of the top tier by diversified giant Anglo American which continues to climb the rankings after years in the wilderness.

New entrant to the top 10 is high-flying China Molybdenum, the best performing mining stock in the world this year with a 150% gain in value year-to-date. The company started the year in 31st spot. The Luoyang City-based base metal giant is now worth more than $20 billion (also the bar for admittance to the top ten) as its acquisition spree of recent years begins to pay off in a big way.

Another company making the most of the rally in copper and zinc this year is KAZ Minerals which joins the Top 50 for the first time. The Kazakh company is up 120% in 2017 and worth $4.7 billion. At the beginning of 2017 a market value of less than $4 billion was enough for entry into the MINING.com Top 50.

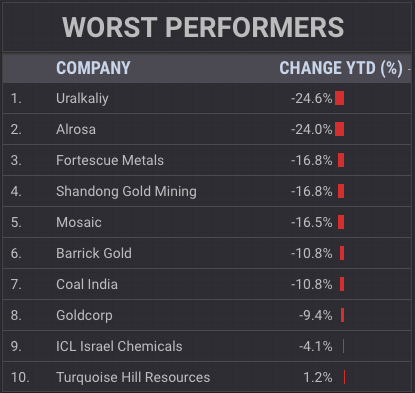

Only nine out of 50 firms are trading in negative territory for 2017 with Russian operations and potash proving a deadly combination. Russian diamond miner Alrosa has had a dismal year suffering a similar fall as that of Uralkaliy, the worst performing mining stock this year. The potash producer’s 24% decline drops the company from position number 30 at the start of the year down to a 44 ranking.

Dropping out of the Top 50 is German-based potash miner K+S after losing over 10% of its value in 2017. Of the four remaining fertilizer miners in the Top 50, Potashcorp of Saskatchewan bucked the weaker trend with an 8.4% gain this year as it looks to close the merger with US-based Agrium to create the world’s largest producer of the crop nutrient.