Summary

An important test of gold’s short-term rally lies ahead.

Stock market weakness will test gold’s fear factor in the coming days.

Relative strength considerations still support gold’s immediate uptrend.

Gold’s “fear factor” is about experience its biggest test in weeks. The latest sell-off in equities threatens to unlock the floodgates of unrestrained upside pressure on the dollar index as investors seek the safety of cash. While this in turn could undermine gold’s autumn turnaround and reverse its recent gains, I’ll argue here that the evidence still favors gold benefiting from the climate of fear despite the dollar’s latest surge.

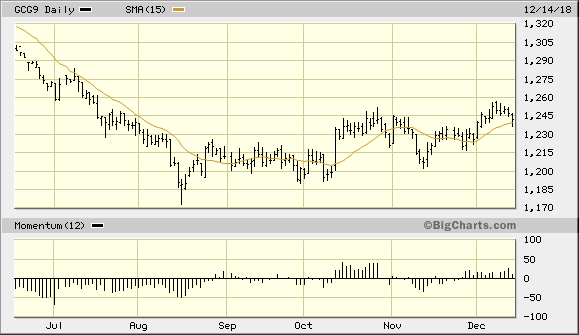

Gold had its largest weekly decline of the last five weeks on Friday, thanks in part to a rally in the dollar. In recent sessions, investors have clearly paused to consider the interest rate outlook ahead of the latest FOMC meeting on Dec. 18-19. This can be seen in the February gold futures chart, below. Last week’s pullback in the gold price was both shallow and orderly, which is typical of a normal reaction following a rally in a market where bulls control the immediate trend.

Source: BigCharts

In Friday’s trading session, however, the gold price fell briefly under the 15-day moving average before rallying back above it on a closing basis. This tells us that the bulls are still in control of gold’s immediate-term (1-4 week) trend and are fighting hard to maintain that control in spite of stiff headwinds from the strong dollar. The gold price has also established a series of higher highs and higher lows over the last two months since confirming an immediate-term buy signal per the rules of my trading discipline. This further confirms that the gold bulls still enjoy a technical advantage over the bears despite the latest dollar rally.

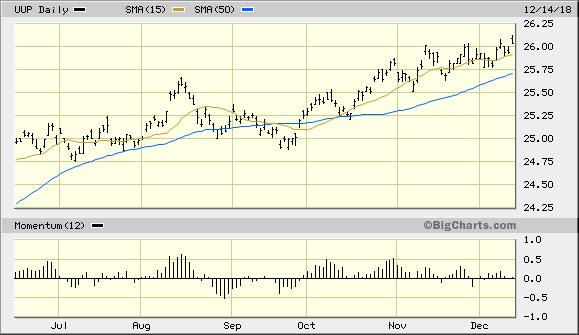

The U.S. dollar meanwhile neared its highest level of the year last week as worries over global economic slowdown proliferated. Shown here is the Invesco DB US Dollar Index Bullish Fund (UUP), a dollar ETF which often provides a “cleaner” chart view of the greenback’s day-to-day movement. Here, you can see that UUP hit a new high for the year last week. Gold’s currency component is the single most important factor which determines its intermediate-term (3-6 month) trend. For this reason, new highs in the dollar are always a nerve-wracking experience for gold traders due to the potential for these new highs to catalyze bear raids in the gold market.

Source: BigCharts

Gold’s resilience in the face of the strong dollar is purely a testament to its “fear factor,” which we’ve discussed in the last few commentaries. Having to rely on the fear factor alone is a worrying prospect, for fear is a temporary emotion which tends to burn itself out fairly quickly. Moreover, there is a definite reason for expecting the fear factor to be seriously tested within the next several days. That reason revolves around the recent increase in U.S. equity market weakness.

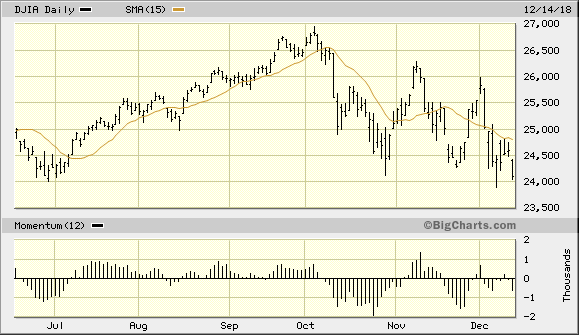

Consider that the widely-followed Dow Jones Industrial Average (DJIA) closed last week at its lowest level since June. This occurred amidst a sharp increase in the number of NYSE-listed stocks making new 52-week lows, prompting fears that another plunge lies ahead for the U.S. broad market. If that’s true – and the technical weight of evidence supports this view – gold’s fear factor will experience perhaps its biggest test since October. If investors run to the dollar while stocks weaken, gold will suffer to some extent since gold strength tends to weaken the metal’s price. However, the relationship which has manifested itself since October has been for equity weakness to actually benefit the gold price. There is also a reason for expecting this inverse relationship to continue.

Source: BigCharts

Support for the view that gold can enjoy continued demand as panicky investors turn toward the relative safety of the metal during stock market weakness is provided below.

Shown above is the Gold:DJIA ratio, a comparison of gold’s strength versus the stock market. Gold currently enjoys a clear relative strength advantage over equities as the following graph illustrates. This is in marked contrast to the first nine months of this year when the Dow was decisively stronger compared to gold. Persistent relative strength in gold vis-à-vis the stock market is a strong argument in favor of owning gold from at least a short-term trader’s perspective. Hedge funds and commodity fund managers give serious credence to relative strength ratios and often initiate trading positions in gold when the metal is outperforming stocks.

Source: StockCharts

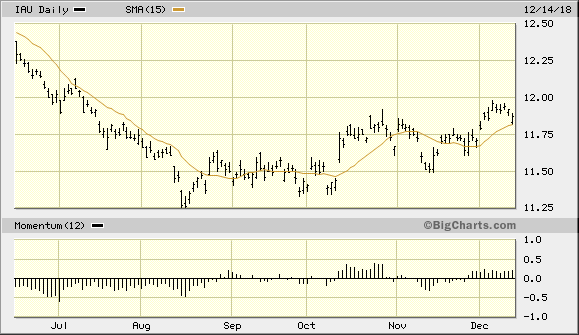

Turning our attention to the iShares Gold Trust (IAU), the gold ETF remains in an immediate-term uptrend despite the lack of participation of other leading inflation-sensitive commodities. This is confirmed by the fact that IAU is still above its rising 15-day moving average after confirming a buy signal by closing two days higher above this trend line in October. In previous reports, I’ve made the case that a close above the late Oct. 26 high of $11.92 would confirm a trading range breakout for IAU and would likely result in some additional short covering. This level was broken on the upside on a weekly basis on Dec. 7, which should pave the way for some additional follow through in the immediate term. Traders should be prepared to book some profits in IAU on its next rally based on the heightened potential for volatility previously discussed. I also recommend maintaining the stop loss at slightly under the $11.50 level on an intraday basis for this trading position.

Source: BigCharts

Despite a surge in the dollar index, gold’s fear factor is still the main driver supporting gold demand among nervous investors in an unsettled financial market. Gold’s clear-cut relative strength advantage over equities argues in favor of the yellow metal price remaining buoyant in the near term, and gold’s immediate-term buy signal from October is still intact. However, while the intermediate-term outlook for gold is still bullish, investors should refrain from loading up on gold until metal’s currency component strengthens. This means that investors should continue to walk slowly and expect gold rallies to be of limited duration until the U.S. dollar index drops sharply. In the meantime, traders can remain long the gold ETF mentioned above.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.