Summary

Regulus with good infill drilling results at AntaKori.

Continental posts more high grade results from drilling BMZs.

K92 releases high grade drill results from drilling below the Kora North deposit at Kainantu.

Looking for a community to discuss ideas with? The Gold Commonwealth features a chat room of like-minded investors sharing investing ideas and strategies. Start your free trial today »

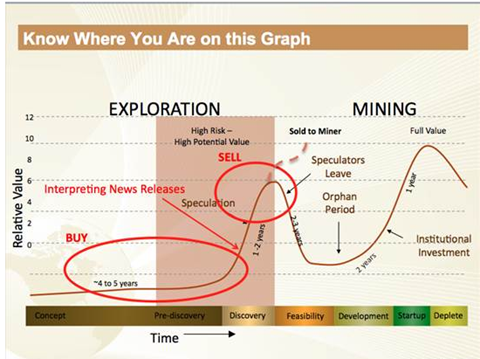

(Source: Exploration Insights)

Introduction

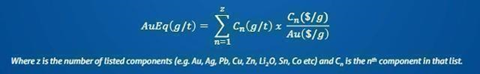

If you’re into investing in the mining sector, you should know the above chart very well. This series covers the three projects with the most significant drill interceptions over the past week as well as the prospects of the companies which own these projects. I will use data from the weekly bulletin of RSC Mining and Mineral Exploration, which can be found on its website. Note that the drill interceptions are converted into grades of gold equivalents using the following formula:

(Source: RSC Mining and Mineral Exploration)

RSC Mining and Mineral Exploration has chosen gold as the metal equivalent for all conversions, as it considers it the most widely used and best-understood benchmark to determine or appreciate the grade tenor of a drilling intercept.

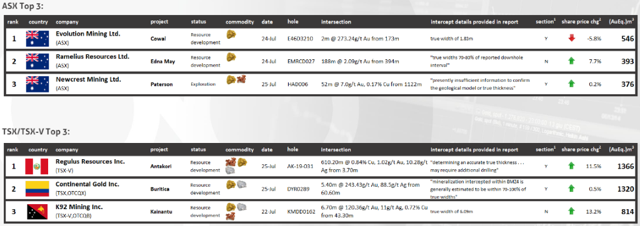

(Source: RSC Mining and Mineral Exploration)

1) AntaKori copper-gold-silver project in Peru

On July 25, Regulus Resources (OTC:RGLSF) announced the results for two additional drill holes from the Phase 2 drill program at its AntaKori copper-gold-silver project and the best result was 610.2m @ 0.84% Cu, 1.02g/t Au and 10.28g/t Ag from 3.7m in hole AK-19-031. This is equal to 1,366(AuEq.)m.

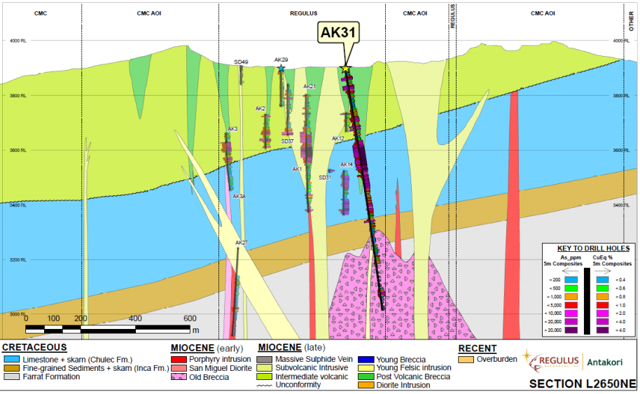

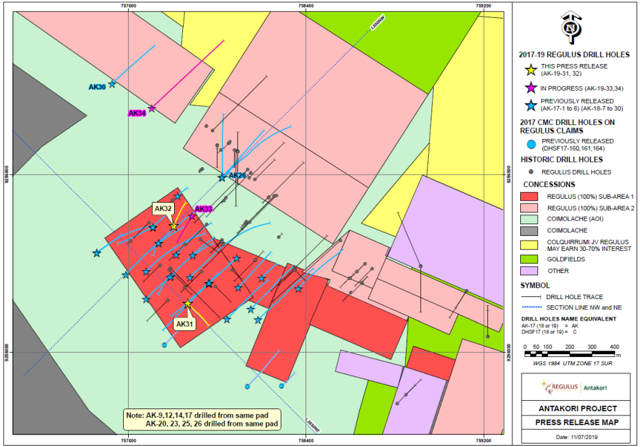

The aim of the 25,000m Phase 2 drill program is to expand and infill resources at the project and the aim of AK-19-031 was to infill an area in the company’s 2019 resource model, located immediately north of the Tantahuatay open pit:

(Source: Regulus Resources)

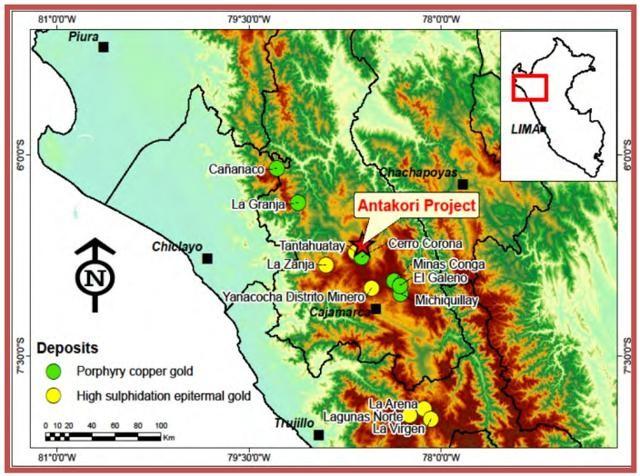

AntaKori is located in northern Peru, just seven kilometers from the Cerro Corona copper-gold mine:

(Source: Regulus Resources)

It’s also adjacent to the Tantahuatay gold project of Buenaventura (BVN) and the two companies are advancing it together.

(Source: Regulus Resources)

In 2018, Tantahuatay produced 173,192 ounces of gold and it’s difficult for either Buenaventura or Regulus to proceed with exploration without mutual agreements.

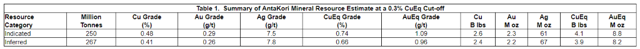

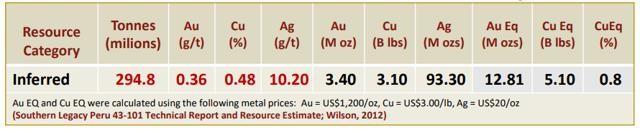

In March 2019, Regulus released new mineral resource estimate for AntaKori which significantly boosted both tonnage and contained metals:

The previous resource estimated featured a mineral resource of 5.1 billion pounds of copper equivalent:

After the Phase 2 drilling program is completed, Regulus plans to complete an updated resource calculation, which will be followed by a PEA.

2) Buritica gold project in Colombia

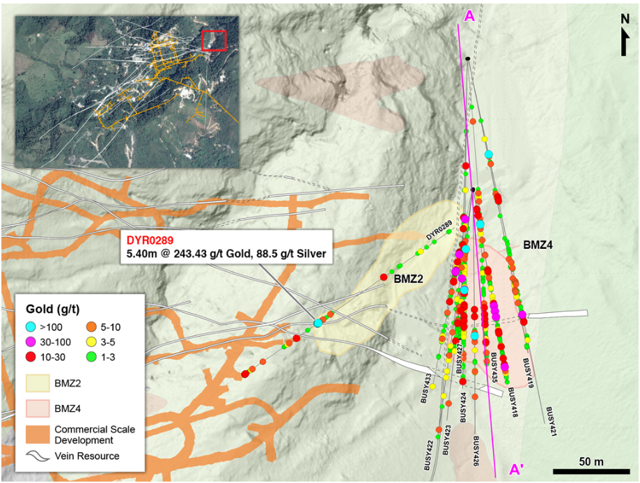

On July 25, Continental Gold (OTCQX:OTCQX:CGOOF) released results from several diamond drill-holes targeting broad mineralized zones numbers two and four at its Buritica project in Colombia and the best result was 5.4m @ 243.43g/t Au and 88.5g/t Ag from 6.60m in hole DYR0289. This is equal to 1,320(AuEq.)m:

Continental said that the high-grade mineralization may be a lateral extension or a component of BMZ2 but further drilling in this area is required. The company thinks there are broad mineralized zones, which encompass much of the material between the project’s defined veins. It’s trying to prove a theory that infill drilling improves the grade of master veins at Buritica and that the vertical dimension of high-grade veins remains continuous at depth.

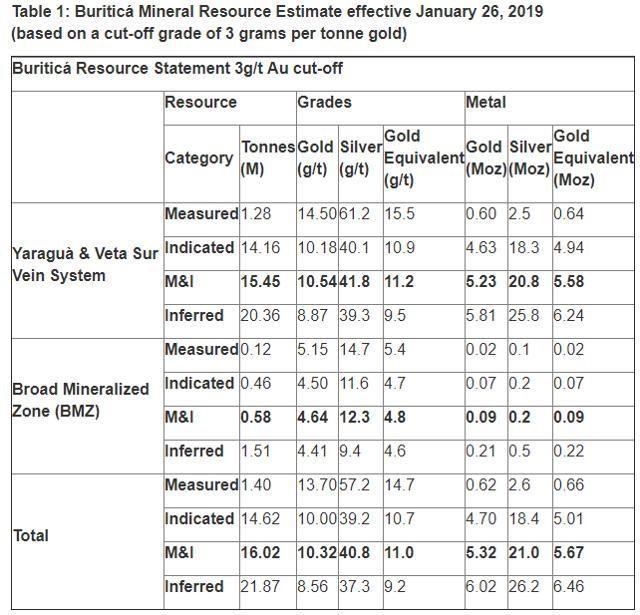

On 30 January, Continental released an updated mineral resource estimate, which boosted gold equivalents in the measured and indicated category by almost a million ounces:

Source: Continental Gold

In March, the company closed a $175 million financing package which should allow it to fully fund the construction of Buritica.

However, I think that there is a major red flag here as the Angry Geologist has recently criticized Continental for potential issues with narrow veins.

3) Kainantu gold mine in Papua New Guinea

On July 22, K92 Mining (OTCQX:KNTNF) released drill results from 11 holes from the Kora North Extension of its Kainantu gold mine. The best interception was 6.7m @ 120.36g/t Au, 11g/t Ag and 0.72% Cu from 43.3m in hole KMDD0162, which is equal to 814(AuEq.)m. The results included multiple holes below the known Kora North deposit as well as the first hole drilled from surface into the zone between Kora North and Kora.

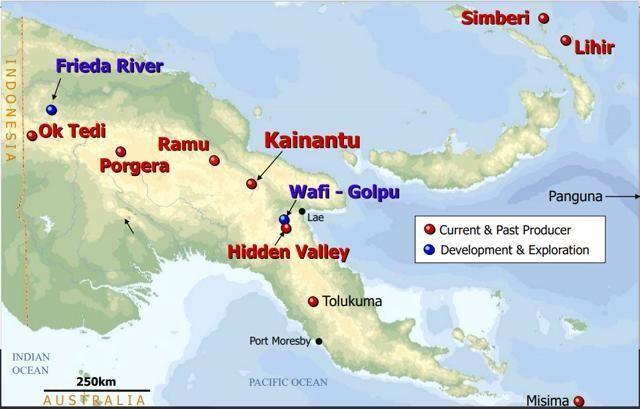

Kainantu is located close to the Wafi-Golpu and Ramu projects in PNG:

K92 was listed in 2016 and I was considering investing in the company back then as it had a large high-grade gold resource of more than two million ounces at an average grade of more than 11g/t AuEq. In 2015, the company bought the project from Barrick (GOLD) for just $2 million plus $60 million in future payments if certain milestones are reached, such as producing more than a million ounces of gold over the next nine years. Barrick itself bought Kainantu for $141.5 million in cash in 2007 and spent around $100 million upgrading infrastructure and on other expenses, and an additional $41.3 million on exploration and expansion activities, including drilling 78,935 meters of core. The owner before Barrick spent another $80 million on development.

Kainantu currently has a resource of just over three million ounces of gold equivalent and K92 aims to update the Kora/Kora North resource to five million ounces in 2019:

(Source: K92 Mining)

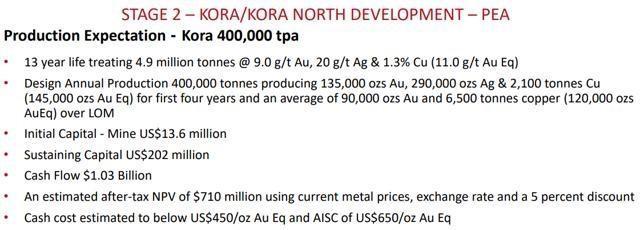

In 2019, K92 plans to produce 68-75,000 oz AuEq in 2019 and 115-125,000 oz AuEq in 2020. The economics of the planned expansion are amazing:

(Source: K92 Mining)

K92 is well-funded at the moment after it raised C$20.7 million through a private placement this week.

Conclusion

Regulus has completed just 4,698m out of the planned 25,000m Phase 2 program at AntaKori and so far it’s successfully infilling and upgrading resources. The project is located next to the Tantahuatay gold project of Buenaventura and I think that a lot of synergies could be realized through a combination of the two. The company currently has a market capitalization of just over $100 million, which seems cheap in view of AntaKori’s potential.

Continental Gold has been regularly releasing high grade results for Buritica over the past months and it has secured enough funding to finish the construction of the project. Buritica is considered one of the best gold projects in the world with a potential to reach 30 million ounces of gold but there are some serious issues. The economics of Buritica have deteriorated over the past several months with an increased initial capex and higher all-in sustaining costs of around $600 per ounce. Also, the Angry Geologist has criticized the company for the way it reports the drill results for narrow high-grade veins. With a valuation of over $600 million, the company seems undervalued, but this is only if there are no issues until Buritica enters into commercial production.

K92 released another set of high grade results from Kainantu and the economics of the planned expansion look compelling. However, I remain unconvinced about the prospects of this project. It sounds too good to be true and it has a checkered past. The measured and indicated resources are just over 0.6 million ounces of AuEq and the previous owners spent over $200 million before deciding to sell it for next to nothing.

If you like this article, consider joining The Gold Commonwealth.

There’s a two-week free trial and the service will focus on long ideas, takeover targets, turnarounds, exploration stories and under-followed gems in the mining space, particularly gold. Omnis Quis Coruscat Est Or!