Summary

Lion One Metals is a barbell investment play.

It has the high-grade gold resource in an advanced stage of development, cushioning the downside. Gold production expected as early as 2020 will provide it with precious cash flow.

Numerous shallow targets and the newly-recognized alkaline porphyry prospect in the depths point to enormous upside.

The jockey on the promising horse, so to speak, is Wally Berukoff, a serially-successful entrepreneur with substantial skin in the game.

Looking for a portfolio of ideas like this one? Members of The Natural Resources Hub get exclusive access to our model portfolio. Get started today »

Investment Thesis

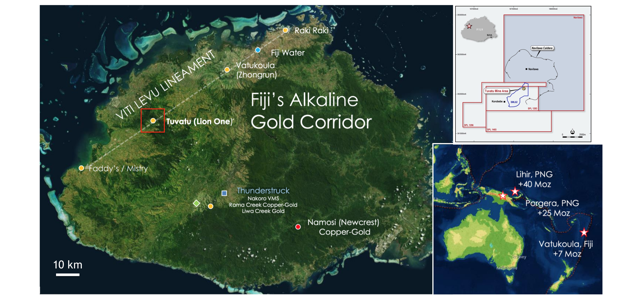

Lion One Metals (OTCQX:LOMLF), a junior gold explorer operating in Fiji, part of the southwestern Pacific ring of fire where giant gold mines such as Lihir, Porgera, and Vatukoula were found, checks a lot of boxes.

Lion One has started developing the Tuvatu epithermal gold veins system, a capital-light, high-grade, high-IRR deposit, with the first gold expected as early as 2020. In addition, the company holds royalty interest in a South Australia iron ore project, which can generate $200 million over time. Those are the visible stuff.

What makes Lion One an exciting stock is that the company just recognized, with Quinton Hennigh advising, that beneath the shallow epithermal vein prospects – which it has not even finished drilling – probably occurs a massive alkaline porphyry gold and copper system. A literature search reveals such dual mineralization in the area has actually been rigorously documented by academic researchers, adding to the credibility of the new claim.

My conservative valuation led me to believe, at the current share price, the market has not priced in the latent value of this new upside; neither has it given credit to the royalty interest on iron ore. I think this is a barbell strategic play: huge upside associated with high-risk exploration is balanced by near-future gold production.

One last thing: Lion One is run by Walter Berukoff, a serially-successful entrepreneur, a frugal operator, a shrewd dealmaker, and major (~21%) shareholder.

The Tuvatu Project

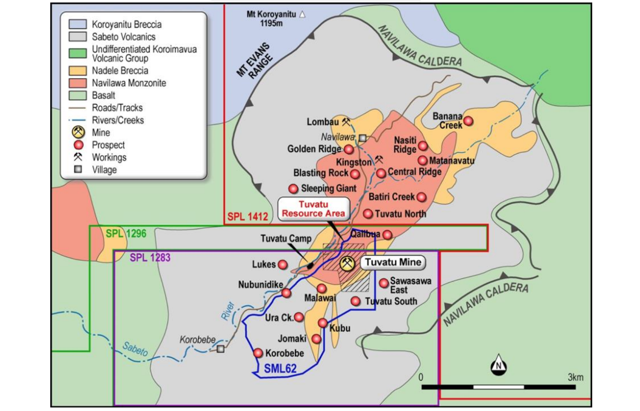

The Tuvatu Project is located approximately 15km north-east of the Nadi Airport on the western coast of the Viti Levu Island of Fiji.

- The original project covers three contiguous Special Prospecting Licences (i.e., SPL 1283, SPL 1296, SPL 1465) totaling 10,565 hectares.

- In 2017, Lion One Metals was awarded SPL 1412, which covers 10,200 hectares including the Navilawa Caldera and is immediately adjacent to the three afore-mentioned leases (see here).

- The company received Special Mining Lease or SML 62 in March 2015, which covers 385 hectares and contains all of the current NI 43-101 resource and multiple high-grade prospects (see here)(Fig. 1).

Fig. 1. The location of the Tuvatu Project on the Viti Levu Island, Fiji, showing it as part of the alkaline gold corridor, modified from source.

2015 PEA

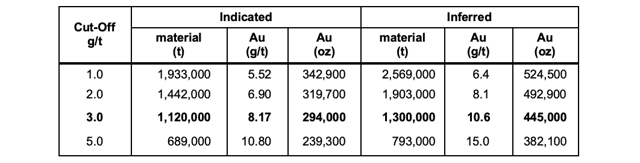

As of 2015, the Tuvatu project is estimated to have 294 Koz of indicated gold and 445 Koz of inferred gold at 3.0 g/t cut-off (Table 1).

Table 1. The resource estimate as of January 2015. Source.

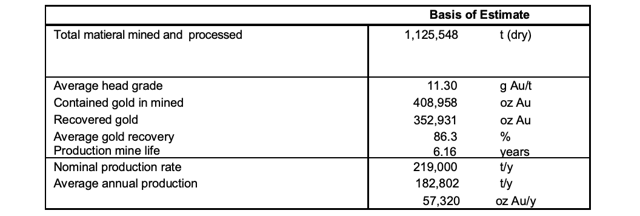

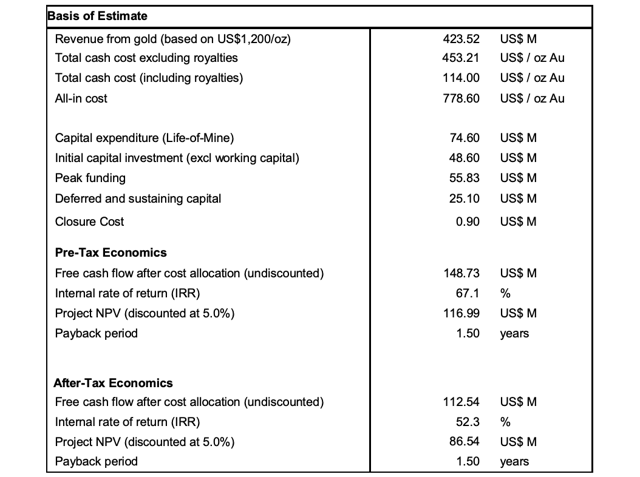

According to the June 2015 PEA, Lion One envisions average production of 353,000 oz of 11.3 g/t gold in 7 years, including 262,000 oz at 15.30 g/t through year three, at an all-in cost of $779/oz. Total CapEx of $48.6 million includes a contingency of $6.1 million with an 18-month pre-production schedule and 18-month payback on capital. At a $1,200/oz gold price, the project is anticipated to generate a net cash flow of $112.66 million at an after-tax IRR of 52% (Table 2). The excellent economics of the mining project benefits from a combination of factors, including (1) the fact that Lion One owns 100% of the project, without any Net Smelter Return (or NSR) involved except for the 5% royalty to the Fijian government, (2) the high-grade mineralization, and (3) presence of free gold and low sulfide content.

Table 2. The Tuvatu project production and cash flow. Source.

On the back of the compelling results of the PEA, Lion One decided to short-cycle the project, by developing and producing from the fully-permitted SML 62 while continuing to explore the rest of the license area for additional resources at the same time.

Construction started in November 2017, using Fijian company A.R. Quarry and Concrete Ltd. as the contractor, with earthworks originally planned to be substantially complete in 2Q2018 (see here) but, due to the wet season, will not be completed until October 2019. The refurbished mining equipment fleet ordered in July 2018 is expected to start to arrive in Fiji in mid-2019 (see here).

Upside potential

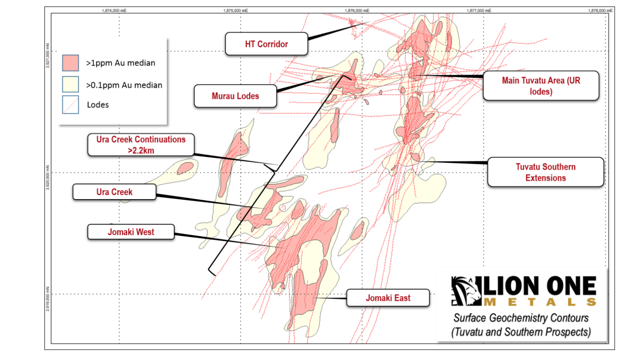

If the gold resources as in the 2015 PEA were all Lion One has, Tuvatu would be just another high-grade but relatively small gold project. Two factors, however, make Tuvatu stand out. Firstly, only about 10% of the project has been drill-tested so far, implying a great exploration upside (Fig. 2). The Tuvatu project is truly a district-scale one.

Fig. 2. Surface geochemistry footprint in the Tuvatu Mining Lease area, including and beyond the Upper Ridge lode in the main Tuvatu area. Source.

Secondly, Lion One had always explored Tuvatu as an epithermal vein system, which is expected to occur at shallower depths no more than a few hundred meters. But Quinton Hennigh, a mining doyen who has recently been appointed a Technical Advisor, told the company he believed Tuvatu was actually an alkaline porphyry system (see here). Hennigh said on March 1, 2019:

“I recently visited Walter Berukoff and his Fiji exploration team and I’m very excited to provide strategic technical advice to Lion One on Tuvatu. After completing my site visit and technical review I believe that Tuvatu has similarities not only to Vatukoula and other large alkaline systems in the South Pacific, but also to several multi-million oz. alkaline gold systems I’m familiar with in North America. Given that only a very small volume of the overall system has been explored, I see excellent potential for growth at Tuvatu.”

This epiphany changed everything; because an alkaline system tends to extend into greater depths and richer mineralization tends to be found at greater depth, Tuvatu may be much bigger. The company essentially just scratched the surface of a gold deposit which is potentially one or two magnitudes bigger than originally thought.

Hennigh then helped Lion One develop an aggressive plan to explore the full extent of the Tuvatu project.

Exploration plan

Analogs. Previously, scholars have studied epithermal and porphyry gold and copper mineralization in the area of the Navilawa Caldera, precisely where Lion One holds licenses. N.A. Forsythe, P.G. Spry, and M.L. Thompson published an article on January 9, 2019, stating:

“Alkaline igneous rocks of the Navilawa caldera host the Tuvatu low-sulfidation epithermal gold deposit, porphyry copper-gold-style mineralization and several other epithermal gold veins, including the Banana Creek and Tuvatu North prospects. Although porphyry- and epithermal-styles of mineralization is telescoped in the Tuvata deposit over hundreds of meters, there is a greater physical separation between these styles of mineralization elsewhere in the Navilawa caldera. Potassic, propylitic, and phyllic alteration occur throughout the Navilawa caldera with phyllic alteration being most closely associated with epithermal gold mineralization. Diffuse propylitic alteration occurs throughout the caldera and is most intense where spatially associated with porphyry- and epithermal-style mineralization.”

These authors confirmed the broad similarity between the Navilawa caldera and Tavua caldera, where the Emperor mine (11 Moz) is located, in terms of sharing the Viti Levu Lineament (Fig. 1), the composition of the alkaline igneous rocks of the almost identical age, and the presence of both low-grade porphyry copper and epithermal gold-telluride mineralization. Tuvatu fits a long list of typical characteristics of alkaline-related epithermal-porphyry systems, including the presence of gold tellurides, vanadium-minerals (see here and here). The Vatukoula district (Emperor mine) is a bona fide analog for exploration in the Tuvatu project.

On a regional perspective, Porgera mine (25 Moz), Lihir mine (40 Moz, aka Ladolam) and Mt. Kare deposit (4.3 Moz) in Papua New Guinea are also analogs. Alkaline magmatism-related gold (-copper) mineralization in island arc tectonic environment is of global significance, as manifested by Grasberg and Lihir among others. This bodes well for the exploration upside of the Tuvatu project. Unequivocal identification of Tuvatu as alkaline-related mineralization instantly upgrades the upside potential of the project.

Alkaline-related gold systems are not only potentially large in resources (Cripple Creek and Grasberg both being alkaline-related, see endnote) but can also be particularly attractive for environmental and metallurgical reasons thanks to their feldspar and carbonate-rich alteration and low sulfide total concentrations (see here). These features help lower development costs and environmental impact.

Exploration plan. Tuvatu being explored as an alkaline system means new exploration focuses will be not only on the undrilled high-grade, shallow epithermal gold prospects but also porphyry system in the depths. Lion One’s immediate goal is to generate a pipeline of new drill targets. To that end, the company plans to undertake bulk leach extractable gold (BLEG) stream sediment sampling over the entire concession area for target identification (Fig. 3)(see here).

Geophysical surveys will be conducted after the wet season. The company will conduct an initial CSAMT (controlled-source audio-frequency magnetotellurics) program to identify mineralized structural zones to depths of up to 1,000m and to gain insight as to deep structural controls of the high-grade vein network in the Navilawa caldera. The company also plans to collect closed-spaced gravity measurements to help understand structural controls.

Lion One envisions a two-tier approach to drill testing the Navilawa gold district:

- Step-out drilling around the known Tuvatu high-grade vein system. More than six areas within the leases, all within 500m of the existing resource, appear to potentially host significant extensions of this important vein network. The vein network at Tuvatu remains open in all directions and at depths. The CSAMT will help identify drill targets beyond the Tuvatu deposit.

- New targets within the Navilawa caldera complex. Multiple untested mineralized areas are readily evident from historic soil and rock chip sampling; The CSAMT and mapping will better define these targets and BLEG will likely add new targets, possibly over 10 by later 2019.

Fig. 3. A map showing the district-scale of the Tuvatu project, with the geological extent of the Navilawa caldera shown. Source.

Valuation

Liquidation value. Let’s first estimate the value of the booked gold resources Lion One is currently developing.

- The median benchmark transactional value of in-the-ground gold was US$30-40/oz, based on 253 gold deposits acquired in 1990-2013 (see here). Eight transactions between 2010 and 2012 in South Africa had a mean price of US$53/oz (see here). As a more recent (2019) analysis of some 226 publicly-disclosed transactions of gold deposits concludes, large (>4.75 Moz of gold equivalent) gold deposits of low grades (<3 g/t gold equivalent) in a high country risk environment were traded at US$19/oz on average, after having controlled for the factors of grade, resource size, and country risk (see here).

Because SML 62 gold resource is high-grade, of low total sulfide content and in an advanced stage of development, I reckon it should capture a much higher metric than the above benchmark. However, just to err on the conservative side, let’s assume SML 62 in-the-ground gold can be sold at $40/oz. At that metric, SML 62 is valued at $30 million.

Adding estimates for the value of the tenements and the newly acquired drilling rigs and cash in hand, I believe Lion One is worth at least $46 million or $0.41 per fully-diluted share in asset liquidation. Please note, that is definitely a conservative estimate because nobody can acquire the tenements for a mere $2.5 million now that Hennigh has confirmed its high potential as an alkaline gold system.

Net asset value. According to the 2015 PEA, the after-tax NPV-5 of the Tuvatu deposit is $87 million, much higher than the $30 million transactional value of in-the-ground gold as I estimated above; the tenements are carried at $41.53 million. Adding the value for newly acquired drilling rigs and cash in hand, Lion One has a net asset value of $142 million or $1.28 per share.

The share price of $0.54 per share as of July 29, 2019, is tantamount to paying merely $0.14 per share for (1) all the exploration potential beyond the Tuvatu deposit, which I believe represents less than 1/10 of what the entire district may hold, and (2) the economic benefit from divesting the Olary Creek iron ore project, South Australia, including a royalty of 1% FOB plus A$0.75/t sold (or a 2% FOB royalty), on all iron ore or manganese concentrates extracted and sold therefrom, which may deliver $200 million in royalty in the future (see here).

Risk

Coup d’etat. Since its independence in 1970, the constitutional democracy in Fiji has been interrupted by two military coups in 1987, social instability in 2000, and yet another coup in 2006. Political risk is real in spite of the relative tranquility since the national election held on 17 September 2014 (see here).

Mining code. Mining in Fiji is governed by the Mining Act of 1978 (revised 1985), which is generally viewed as offering reasonable royalty and taxation structures. Procedures for gaining land access for mineral exploration and development in Fiji is considered favorable in the Southwest Pacific region.

Liquidity. Lion One is in the middle of developing the Tuvatu deposit, which is estimated to cost approximately $39-44 million in total. In addition, Lion One launched an aggressive exploration program, which may cost a few million dollars at the minimum. Its funding situation may directly impact the pace of progress of the ongoing mine building.

- Given its decision to skip a bankable feasibility study, Lion One has been trying to secure financing through alternative approaches. It tried in August 2016 to do vendor financing from Ansteel under an EPC contract (see here), which seems to have fallen through. Then, in June 2018, it signed a letter of intent with two Chinese concerns to borrow $40 million at 7.5% for five years and to get a 2-year principal holiday and an option to increase the loan by $10 million (see here). It is unclear whether this alternative financing will lead anywhere as China tightens capital outflow.

Thanks to C$38.6 million equity capital raised in 2016 (see here), Lion One still had working capital of C$10,659,737 including cash of C$10,503,837 as of March 31, 2019 (see here). A more recent document indicates the company had $12 million of cash (see here).

The company says “it has adequate financial resources for the next twelve months” (see here). However, one may not rule out an equity capital raise in the near future, especially as the share price has appreciated over 60% year to date.

Geology and geologists. The concession area has previously been thoroughly investigated by academic geologists (with more research project ongoing), who confirmed the company’s claim that it is an alkaline-related gold district. So I do not worry as much about the subsurface exploration potential as hoping the technical team, comprising Stephen Mann (Managing Director) and Darren Holden (VP-Exploration) under the guidance of Hennigh, will execute well.

The management. Walter Berukoff, Chairman and CEO, is a serially-successful entrepreneur; he founded Northern Orion Resources which was sold to Yamana (AUY) for $1.07B in 2007 (see here), Miramar Mining which was sold to Newmont (NEM) for C$1.5 billion in 2008 (see here), La Mancha Resources which was sold to Egyptian billionaire Naguib Sawiris for $492 million in 2012 (see here). The stellar track record has earned Berukoff a golden name in the junior mining circle. In addition to institutional investors Donald Smith & Co. (14%), Franklin Precious Metals Fund (9.99%), JP Morgan Asset Management UK (6%, reportedly selling), and Aegis Value Fund (2.8%), he also attracted, e.g., Australian investor Mark Creasy to the Lion One investor throng (see here).

Berukoff seems to be more of a quiet doer than a promoter, truly a rarity in the junior mining patch, where you may run into 1 serial scamster, 2 thieves from shareholders, and 3 lifestyle executives out of every 10 CEOs. He is not known as the type of founders who profit by selling concessions to the public company he heads while retaining a 2% NSR. Even the related-party transactions, e.g., here, do not seem so unreasonable. He, along with other insiders, holds some 22% of the outstanding shares, giving them considerable skin in the game.

Operationally, Berukoff seems to be enterprising yet frugal. For the Tuvatu development project, he chose to buy refurbished mining equipment for the expected 7 years of mining.

- Because drilling is expensive in so secluded and remote market as Fiji, he bought Fijian drilling company Geodrill, thus securing rig availability and saving future capital expenditures (see here).

- Lack of geochemical assay and metallurgical laboratories in Fiji, historically, led to 4-6 weeks of turnaround times for Lion One to receive sampling results from overseas (Australia or Canada) laboratories “at a significant cost that included other logistics such as customs clearance, freight, transport, and analysis“. So the company built a new geochemical assay and metallurgical laboratory, hoping to reap benefits from 24-48 hour turnaround on results, which is scheduled to be operational by mid-2019 (see here).

Investor takeaways

Previously, I said the following regarding stock-picking among junior miners:

Correctly picking the select few junior miners with the following characteristics is proven to potentially lead to enormous investment gains: The junior miner must be actually working on appraising what is judged, by a trained technical expert, to be a world-class deposit in a globally important mining district; It must be adequately funded, preferably by major financial backers which are capable of extensively vetting the project; It must be managed by a team of serial entrepreneurs and exploration geologists who have worked together over many years, made a series of major discoveries, and shepherded the finds through the jungle of local community affair, permitting processes, and commodity cycles to fruition and who must have substantial skin in the game.

As a junior mining stock, Lion One Metals checks a lot of boxes. To begin with, it is run by Walter Berukoff, one of the most respected in the junior mining circle, a serially successful entrepreneur; he is thrifty, shrewd, and of considerable skin in the game.

The company holds a district-scale property in the southwestern Pacific gold belt, known for multiple giant gold mines dotting the Ring of Fire. The 20,765-ha concessions include a mining license, where ongoing is capital-light development of high-grade epithermal gold resources, and prospecting leases targeting an alkaline-related gold system including additional shallow, epithermal prospects and so-far unexplored, porphyry-style, copper-gold mineralization in the depths. The concessions are believed to potentially hold multiple times of currently-booked resources, for which the company just announced an aggressive exploration program. Pursuing dual goals of quick-turnaround development and ambitious exploration, Berukoff proves himself to be an old hand in applying the barbell strategy.

The company’s recent appointment of Quinton Hennigh as Technical Advisor catalyzed its stock to escape from four years of congestion. However, my valuation seems to suggest the stock is still undervalued (Fig. 4).

From the analysis above, I believe the stock offers an attractive risk-reward profile to someone who is willing to wait in the next two years for the first gold and to be surprised by drill intersections. The downside is backstopped by the liquidation value at $0.41 per share (-24% from the current share price), by the first pour of gold expectedly as early as 2020, and by royalty interest in an iron ore project in South Australia; the upside, not limited by the current net asset value at $1.28 per share, will be excellent if the shallow targets prove to be auriferous or enormous if the ongoing exploration program on the back of the alkaline gold concept plays out. This, in my opinion, qualifies as a barbell investment play.

Fig. 4. Stock chart of Lion One Metals. Source.

If you like the article above, then you may want to check out The Natural Resources Hub where a portfolio of high-alpha investing ideas are covered in various angles, monitored, and discussed by a community of investors…

Sign up today at The Natural Resources Hub and benefit from Laurentian Research’s in-depth research right away!